Explore Your Alternatives for Hassle-Free Savings Account Opening Near You

In today's economic landscape, the procedure of opening a bank account can typically appear complicated, yet it does not have to be. Recognizing the different types of accounts, needed paperwork, and the actions entailed can greatly simplify this endeavor.

Comprehending Savings Account Kind

Understanding the various sorts of checking account is essential for making educated economic decisions. Savings account typically drop right into numerous categories, each developed to satisfy certain economic requirements. The most typical kinds consist of interest-bearing accounts, checking accounts, and deposit slips (CDs)

Savings accounts are excellent for people looking to store funds while gaining rate of interest. These accounts frequently have actually limited withdrawal options yet typically offer greater interest prices compared to examining accounts.

Deposit slips (CDs) are fixed-term accounts that need funds to be deposited for a specific period, usually producing higher rate of interest than standard savings accounts. Nevertheless, very early withdrawal may sustain penalties. Other specialized accounts consist of money market accounts, which integrate attributes of cost savings and examining accounts, and individual retired life accounts (IRAs), which provide tax obligation advantages for retired life savings. Comprehending these account kinds empowers people to choose the most suitable alternatives for their monetary objectives.

Picking Between Online and Neighborhood Bankss

When selecting a bank, individuals typically encounter the choice between online and regional bankss, each offering distinctive benefits and downsides. On the internet bankss commonly provide higher rates of interest on interest-bearing accounts and reduced costs due to reduced overhead costs. bank account opening. Their 24/7 ease of access allows customers to manage their finances conveniently from anywhere, making them an appealing alternative for tech-savvy people

Security is another essential factor to consider. While on-line bankss utilize sophisticated file encryption and protection actions, some people may still feel much more comfy with the physical visibility of a local bank, where they can see staff and operations firsthand.

Inevitably, the choice in between online and neighborhood bankss relies on individual choices and financial demands. Evaluating elements such as benefit, charges, rates of interest, and customer support will assist individuals choose the banking solution that best fits their lifestyle.

Required Documents for Account Opening

Before starting the account opening procedure, it is necessary to collect the essential documentation to ensure a smooth experience. Different bankss might have details requirements, but there prevail files that you will commonly need.

First of all, a valid government-issued picture identification is important. This can include a copyright, key, or nationwide copyright. Secondly, evidence of address is typically required; appropriate files might include energy expenses, lease agreements, or bank statements that plainly display your name and existing address.

In addition, depending upon the kind of account you wish to open, you might need to supply your Social Safety number or Tax obligation Identification Number for tax obligation purposes. Both celebrations will certainly need to provide their identification and proof of address. if you are opening up a joint account.

Actions to Open Your Account

Opening up a checking account entails a simple series of actions that can simplify your financial experience. To start, choose the sort of account that ideal fits your financial demands, whether it's a monitoring, savings, or a specialized account. Once you have actually made your selection, visit your picked bank's branch or navigate to their internet site to start the procedure.

Following, gather the called for paperwork, which usually consists of proof of identification, such as a government-issued ID, and evidence of address, like an utility costs. bank account opening. Some bankss may additionally ask for your Social Security number or tax recognition number

After assembling your papers, fill in the application type, either online or in-person. Ensure that all info is exact and complete to avoid hold-ups.

As soon as you submit your application, the bank will certainly review your info, which might take look what i found from a couple of mins to a number of days depending upon the establishment. If approved, you'll get information about your new account, including your account number and any type of connected debit or bank card. Lastly, make an initial down payment to trigger your account, and you are ready to start banking.

Tips for a Smooth Experience

To make sure a smooth bank account opening up experience, it is advantageous to be well-prepared and notified regarding what to anticipate. Beginning by collecting all necessary documentation, including a valid government-issued ID, proof of address, and your Social Security number. This preparation will speed up the process and stop unneeded hold-ups.

Furthermore, it is a good idea to schedule a consultation with a bank rep. This can assist make certain that you receive individualized assistance and stay clear of long haul times.

As soon as at the bank, ask questions to clear up any attributes or terms associated with your account. Recognizing the fine print can protect against future hassles.

Final Thought

In final thought, detailed study and preparation are necessary for a seamless bank account opening up experience. By recognizing different account types, weighing the advantages of neighborhood versus on the internet bankss, and celebration essential paperwork, individuals can navigate the procedure effectively.

The most common kinds consist of cost savings accounts, checking accounts, and certifications of down payment (CDs)

These accounts typically have restricted withdrawal alternatives however generally supply greater interest prices compared to checking accounts.Certifications of down payment (CDs) are fixed-term accounts that need funds to be transferred for a given period, usually producing higher passion rates than traditional financial savings accounts. Other Read More Here specialized accounts consist of money market accounts, which incorporate functions of savings and examining accounts, and individual retired life accounts (IRAs), which offer tax benefits for retirement financial savings. To begin, pick the type of account that finest matches your monetary needs, whether it's a monitoring, cost savings, or a specialized account.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Taran Noah Smith Then & Now!

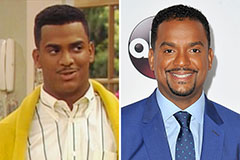

Taran Noah Smith Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!